Claude for Financial Services

Today, we're introducing a comprehensive solution for financial analysis that transforms how finance professionals analyze markets, conduct research, and make investment decisions with Claude.

The Financial Analysis Solution unifies your financial data—from market feeds to internal data stored in platforms like Databricks and Snowflake—into a single interface. Access your critical data sources with direct hyperlinks to source materials for instant verification, all in one platform with expanded capacity for demanding financial workloads.

Our Financial Analysis Solution includes:

- Claude’s industry-leading financial capabilities: Claude 4 models outperform other frontier models as research agents across financial tasks in Vals AI's Finance Agent benchmark. When deployed by FundamentalLabs to build an Excel agent, Claude Opus 4 passed 5 out of 7 levels of the Financial Modeling World Cup competition and scored 83% accuracy on complex excel tasks.

- Claude Code and Claude for Enterprise with expanded usage limits: Modernize trading systems, develop proprietary models, automate compliance, and run complex analyses including Monte Carlo simulations and risk modeling with Claude Code. With Claude, analysts can handle demanding all other workloads across critical market events and deal deadlines.

- Pre-built MCP connectors: Access financial data providers and enterprise platforms for comprehensive market data and private market intelligence.

- Expert implementation support: Tailored onboarding, MCP configuration, training, and best practices for rapid value realization.

Financial institutions require the highest standards of data protection. By default, your data is not used for training our generative models, maintaining confidentiality of your intellectual property and client information.

The AI ecosystem for financial services

We've built the Financial Analysis Solution with leading financial and enterprise technology providers, giving Claude the ability to instantly check information across multiple sources. This creates a fundamentally more reliable way to analyze financial data—information is verified across sources to reduce errors, every claim links directly to its original source for transparency, and complex analysis that normally takes hours happens in minutes.

Through data providers, Claude has real-time access to comprehensive financial information including:

- Box enables secure document management and data room analysis

- Daloopa supplies high-quality fundamentals and KPIs from all public filings, disclosures and presentations

- Databricks offers unified analytics for big data and AI workloads

- FactSet provides comprehensive equity prices, fundamentals, and consensus estimates

- Morningstar contributes valuation data and research analytics

- Palantir builds AI-driven platforms that help governments and enterprises integrate, analyze, and act on large-scale data to make critical operational decisions

- PitchBook delivers industry-leading private capital market data and research, empowering users to source investment and fundraising opportunities, conduct due diligence and benchmark performance, faster and with greater confidence

- S&P Global enables access to Capital IQ Financials, earnings call transcripts, and more–essentially your entire research workflow

- Snowflake provides an easy, connected, and trusted data and AI platform that allows global enterprises to unlock value across all of their data – including structured, unstructured, and semi-structured

All of these integrations will be available today or in the coming weeks.

Accelerating enterprise adoption

Our ecosystem delivers both data access and implementation expertise through leading consultancies. These partners provide tailored solutions across compliance, research, and enterprise AI adoption:

- Deloitte enhances research productivity across equity research, private credit, and municipal bonds through their 10X Analyst

- KPMG helps financial services companies deploy AI assistants and agents to their developers and analysts

- PwC breaks down regulations into discrete obligations, analyzes internal compliance gaps, and generates policy updates through their Regulatory Pathfinder

- Slalom accelerates legacy code modernization through their AI Accelerated Engineering program, and provides solutions for end-to-end insurance operations transformation

- TribeAI helps investment and M&A teams automate deal material review, financial analysis, and entity resolution with VDR integration through their Due Diligence Assistant

- Turing offers auto-generation of compliance requirements in PRDs and Compliance Benchmarking-as-a-service

Use cases

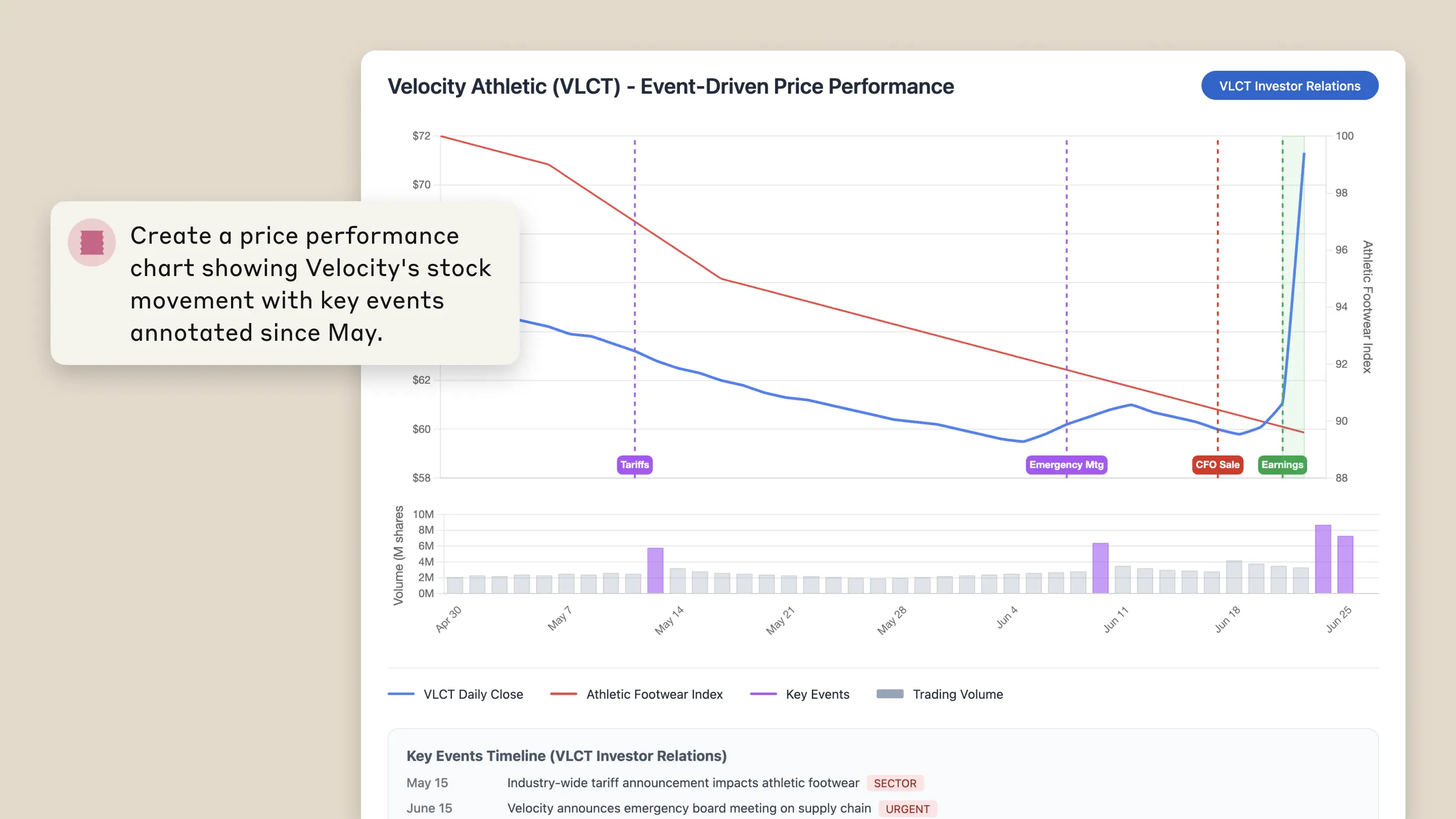

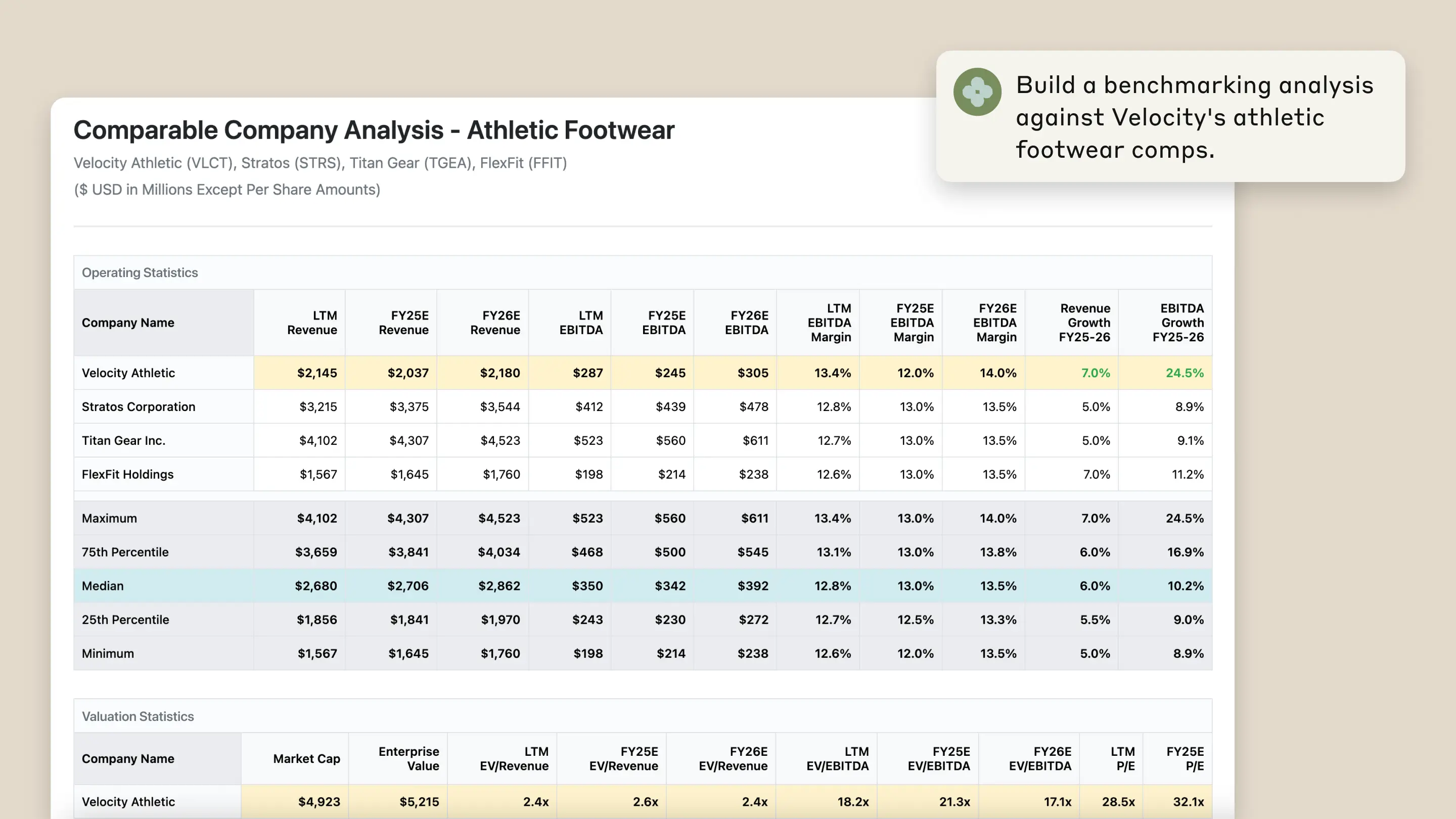

Claude accelerates critical investment and analysis workflows including due diligence and market research, competitive benchmarking and portfolio deep dives, financial modeling with full audit trails, and generating institutional-quality investment memos and pitch decks. Teams can monitor portfolio performance and compare metrics across investments to identify opportunities faster than traditional methods.

Leading financial institutions are seeing proven results:

"We've been developing capabilities powered by Claude since 2023 within AIA Labs. Claude powered the first versions of our Investment Analyst Assistant, which streamlined our analysts' workflow by generating Python code, creating data visualizations, and iterating through complex financial analysis tasks with the precision of a junior analyst." - Aaron Linsky, CTO, AIA Labs at Bridgewater

"Claude has fundamentally transformed the way we work at NBIM. With Claude, we estimate that we have achieved ~20% productivity gains - equivalent to 213,000 hours. Our portfolio managers and risk department can now seamlessly query our Snowflake data warehouse and analyze earnings calls with unprecedented efficiency. From automating monitoring of newsflow for 9,000 companies to enabling more efficient voting, Claude has become indispensable." - Nicolai Tangen, CEO at NBIM

“Our strategic partnership with Anthropic is foundational to our success and our strategy to become a global leader in AI innovation in banking. Claude's advanced capabilities, combined with Anthropic's commitment to safety, are central to our purpose of harnessing AI responsibly, as we drive for transformation in critical areas like fraud prevention & customer service enhancement.” - Rodrigo Castillo, Chief Technology Officer at Commonwealth Bank of Australia

“Our partnership with Anthropic will fundamentally transform how we approach underwriting at scale. With the incorporation of Claude's advanced capabilities into our underwriting process, we have been able to compress the timeline to review business by more than 5x in our early rollouts while simultaneously improving our data accuracy from 75% to over 90%. This collaboration is about propelling growth and providing our underwriters the tools to make better decisions at an accelerated pace, ultimately driving our ability to serve more clients with greater insight." - Peter Zaffino, CEO at AIG

Getting started

Claude provides the complete platform for financial AI—from immediate deployment to custom development. Get started with our tailored Financial Analysis Solution for analysts, build custom applications via our API (underwriting, compliance automation, customer experience, back office transformation), or modernize your code with Claude Code.

For streamlined procurement and consolidated billing, both Claude for Enterprise and the Financial Analysis Solution are now available on AWS Marketplace, enabling you to leverage existing vendor relationships while reducing procurement cycles. Google Cloud Marketplace availability is coming soon.

Contact our sales team to learn more about Claude for Financial Services, schedule a demonstration, or discuss implementation for your organization.